Adequate insurance isn’t just a safety measure—it’s a legal and operational necessity. Without it, you risk non-compliance with regulations, costly penalties, and greater danger on the road. Insurance ensures you meet your obligations while protecting drivers, passengers, and the public. Here’s why the right cover matters for compliance and why it plays such a crucial role in road safety.

The Link Between Insurance and Compliance

Operating without proper insurance isn’t simply risky—it can be unlawful. Transport authorities require businesses to meet specific insurance standards before they’re legally allowed to operate.

Failing to comply can result in hefty fines, suspension of licences, or even closure of operations. If you employ drivers, own commercial vehicles, or provide passenger transport services, your obligations are even stricter. Public liability and compulsory third-party (CTP) cover may be legally required, depending on your state and industry.

Maintaining compliance demonstrates professionalism and helps avoid disputes with regulators, customers, and contractors. Adequate insurance isn’t just a box to tick—it’s an essential part of your licence to operate.

Types of Insurance That Support Road Safety

Not all insurance policies are equal. To fully support compliance and road safety, you need cover that addresses both legal requirements and practical risks.

Compulsory Third-Party (CTP) Insurance

CTP insurance is legally required for every registered vehicle in Australia. It covers compensation costs for people injured or killed in a road accident. Without it, you cannot legally drive or register a vehicle.

CTP doesn’t cover property damage, but it ensures accident victims have access to medical treatment and rehabilitation. This is the foundation of road safety protection in Australia, ensuring no one is left without essential care.

Comprehensive Motor Insurance

Comprehensive insurance goes beyond CTP by covering damage to vehicles, property, and sometimes additional liabilities. For businesses, this is vital because a serious accident can involve multiple cars, public infrastructure, or even commercial property.

Without comprehensive cover, you’d be left covering the repair or replacement costs of your own vehicles and third-party property. Comprehensive motor insurance gives you confidence that your fleet and finances are protected.

Public Liability Insurance

If your vehicles or business activities cause damage or injury beyond what CTP covers, public liability insurance steps in. For example, if a delivery truck damages a client’s property or injures someone while loading goods, liability insurance ensures you’re covered.

This cover is often required by contractors, councils, and landlords before you can operate. It shows that you’re not only meeting legal obligations but also taking responsibility for broader risks associated with your business.

Consequences of Inadequate Insurance

Failing to carry sufficient insurance doesn’t just expose you to fines—it has far-reaching consequences for compliance, finances, and reputation.

Legal and Financial Penalties

Driving or operating without the required insurance can lead to licence suspension, vehicle deregistration, and heavy fines. If an accident occurs and you’re uninsured, you’ll be personally liable for all damages and injuries, which can run into millions of dollars.

These financial penalties are often enough to bankrupt a small or medium-sized business. Even large companies can face severe financial strain if forced to cover accident costs without insurance support.

Operational Disruptions

Without insurance, even minor accidents can cause major disruptions. Vehicles may be off the road for extended periods, delaying deliveries, reducing service capacity, and frustrating customers.

Adequate truck insurance helps you get back on the road faster by funding repairs, replacements, and rental vehicles. This minimises downtime and keeps your business running smoothly despite setbacks.

Damage to Reputation

Clients, partners, and the public expect you to operate responsibly. If news spreads that you were uninsured during an accident, the reputational damage can be long-lasting. Customers may lose trust, contracts can be terminated, and your ability to win new work may be compromised.

Insurance isn’t just financial protection—it’s also a signal of professionalism. Businesses that prioritise insurance show that they take safety, compliance, and responsibility seriously.

How Adequate Insurance Improves Road Safety

Insurance is often seen as reactive—something that only helps after an accident. In reality, it also contributes to proactive road safety.

Encouraging Responsible Driving

Drivers who know they’re covered by proper insurance feel supported, but insurance also places responsibility on businesses to maintain safe practices. Insurers often require vehicles to be maintained to certain standards or expect businesses to implement risk management programs. These measures reduce the likelihood of accidents.

Promoting Quick Recovery After Accidents

When accidents do happen, insurance ensures victims receive medical treatment quickly and vehicles are repaired without delay. This reduces the long-term impact of road incidents and helps keep traffic flowing safely.

For businesses, faster recovery also means less pressure to cut corners or push unsafe vehicles back into service prematurely. Adequate cover ensures road safety remains a priority even during setbacks.

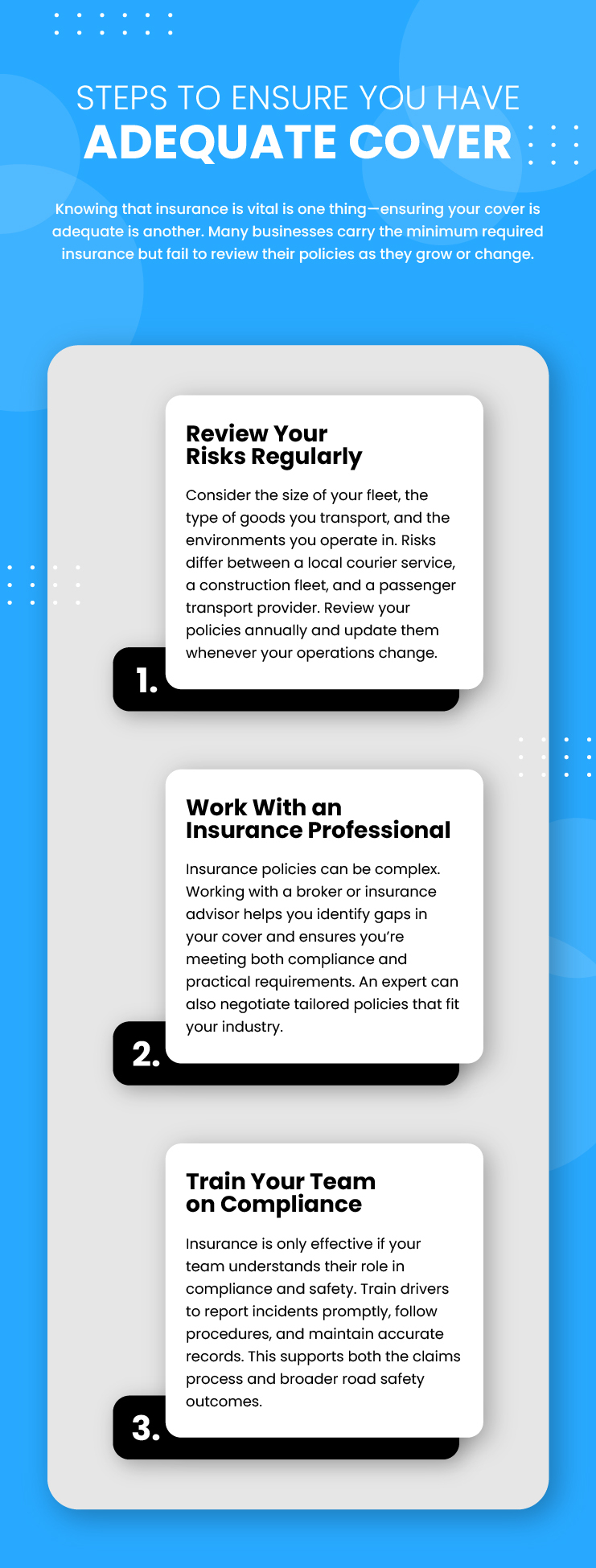

Adequate insurance is more than just a legal requirement—it’s the backbone of compliance and road safety. It protects your business from fines and liabilities, ensures accident victims receive support, and helps you recover quickly when things go wrong.